Remote working as a freelancer has so many comforts and advantages that makes it the best option for thousands of people around the world. The only hard part though, is to choose where and how you‘ll save your earnings. Therefore we decided to create a full review and tutorial about Wise in order to help you elliminate difficulties and save your time. So, lets dive into it!

Wise (former TransferWise) is one of the biggest money transfer providers in the world. Founded in January of 2011 in London by two friends, one of which was Skype’s first employe, had just one goal. Make money transfers cheaper, easier and more secure.

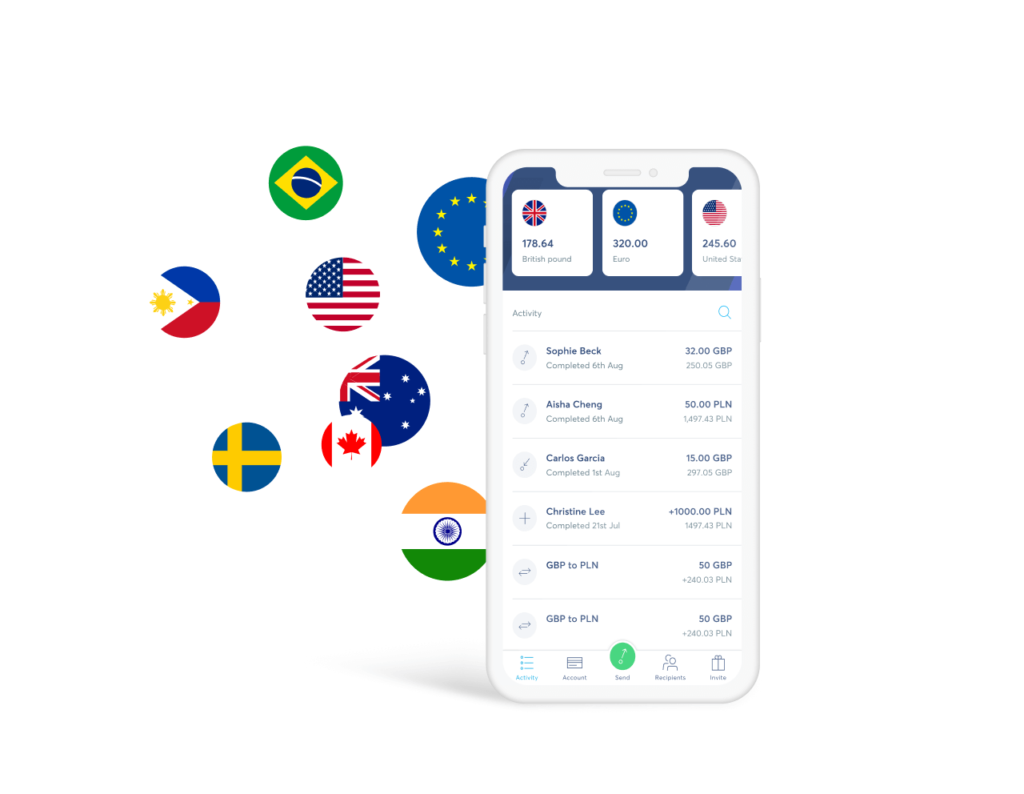

In its first year of its operation, transactions through Wise amounted to €10 million. Today, with more than 13 million users, it continues to grow yet steadily providing its services with some of the lowest fees in the market, supporting 53 different currencies and transactions to more than 80 different countries.

Right below we have listed the Pros and Cons of having a Wise account, check it out!

Pros

- Wise provides multi-currency accounts, all through one application.

- Very low transfer fees with not hidden charges.

- Easy to use services (through desktop or using the Wise application).

- Best exchange rate available in the market.

- Registered with FinCEN, making sure to provide secure transactions.

Cons

- Fund transfers with cash are not supported.

- It doesn’t support all currencies neither clients can transfer funds to all countries.

- Accounts are not interest bearing.

Fees and Comissions

There are two main fees charged by Wise. The first one is card payment fees. To obtain a debit card you have to pay a fee of 7 USD / 6 EUR. Also, in order to make a transfer using your credit card it charges 3.8% – 4.33 % for credit cards and 1.1 % – 1.25 % for debit cards, depending on the purpose of the transfer. These charges are different for different types of currencies. The second one is service fees. Wise charges a fixed fee and a percentage of your transfer amount. The percentage part will vary based on the total amount and in which currencies you are converting. Transfers on wise are also made using the real currency rate with no fees hidden, more than that, they are 8x cheaper than traditional bank’s transfers and 3x cheaper than Paypal. You can check out your specific case on the fee calculator below.

Is wise safe?

Wise is regulated by the Financial Conduct Authority (FCA) in the UK and also by the Financial Crimes Enforcement Network (FinCEN) in the US. It also has state licenses in the US. The certifications of the Wise include SOC 1 Type 2, SOC 2 Type 2, PCI DSS. Wise also holds an ISO 27001 certificate and is GDPR compliant. Furthermore, their platform uses a 2-factor authentication in order to protect its customers’ personal data and money.

How to Create and Register an Account

Before you begin to use Wise’s services you have to create your own account. Do not worry, it’s a very easy and well guided process. All you have to do is follow the steps listed below and your account will soon be ready to use!

1. Move on to the website’s sign-up page.

2. Enter your personal details, your email address and create a strong, unique password.

3. You can use your Google or Facebook account instead.

4. After signing up, check your email. You will shortly receive a verification email.

5. Follow the instructions included in it and complete the verification process.

6. Just wait for your verification to be approved and you are ready to start sending and receiving money!

We know it might not be that easy to understand it all by only reading the brief steps shown above. Keeping that in mind, you can find a full step-by-step tutorial of how to create and register your Wise (ex-transferwise) account on the video below from Olusola David’s YouTube channel.

How to Deposit money

You have already created your account and are looking forward to adding some money to your balance. Here is what you need to do:

1. Login to your account and head to ‘’activity’’ page.

2. Choose the ‘’Add money’’ option and enter the amount that you want to deposit.

3. Select the preferred currency ( fees are visible at this point ).

4. Click on ‘’Continue with Payment’’ and enter your card details.

5. Click on ‘’Pay’’. Your money is now available in your account, ready to use.

How to Send money

Sending money is not much harder than adding money to your account . Some simple steps have to be followed and you can complete your transaction in no time.

1. Enter transaction details (amount of money , destination country , etc).

2. See how much money is going to arrive in the overseas bank account.

3. Enter the bank details of the receiver.

4. Check again all the details you have entered before proceeding and then click ‘’Confirm’’.

5. Pay for the transfer and your money will be on the way to its recipient!

Conclusion

Wise is for sure one of the best options for international transfers. It provides a simple and secure way to transfer funds with low cost. They are also really fast considering the fact that transactions take from a few hours to 2 business days to be completed. Besides that, it’s one of the cheapest options in the market nowadays and Wise is totally transparent regarding their service fees. These are some of the factors that make it the best tool for remote freelance workers needing a way to receive, convert and transfer money in other currencies.